How Treasury Professionals are fighting social engineering and payment fraud – before it is too late

In today’s digital world, protecting your organization isn’t just about securing your physical assets - it’s about safeguarding your financial systems and sensitive information from cybercriminals. One of the most dangerous and growing threats to organizations of all sizes is social engineering, which targets human elements of a process to avoid fraud controls and can show up in thousands of variations.

What is social engineering?

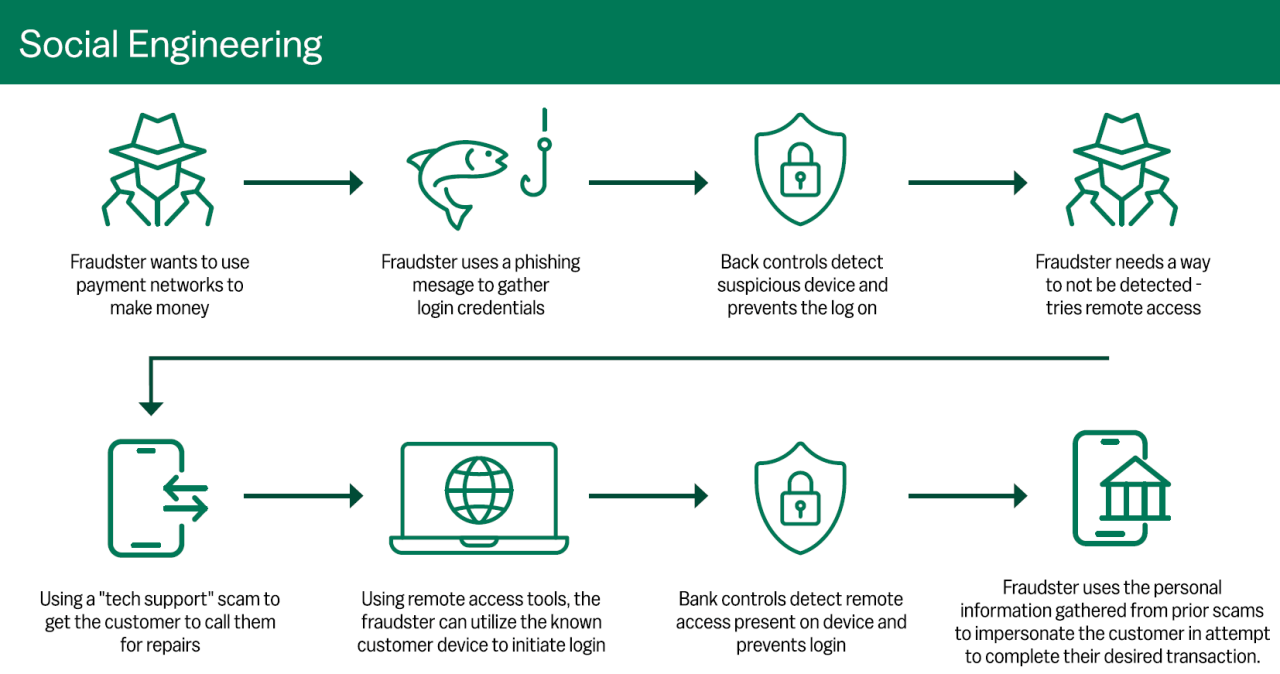

Social engineering is a type of cybercrime where attackers use deception and manipulation - not technical hacking - to trick individuals into giving up confidential information or authorizing fraudulent transactions. Rather than breaking into systems, they “hack” people. This often involves impersonating someone the victim trusts, like a bank representative, a supplier, or even a company executive.

Why executives should care

Social engineering can have a direct and devastating impact on your organization’s finances, particularly through your banking and payment systems. Here’s how:

- Business email compromise (BEC): Hackers use unauthorized email access to gain critical information or finances. Criminals may hack or spoof a vendor’s email account and send realistic-looking requests to your employees - often in accounting or finance - to wire funds to fraudulent accounts. The FBI reported losses of over $1.7 billion in a single year from BEC scams.

- Phishing attacks: Fraudsters may send emails that appear to come from your bank or vendors, asking you to “verify” account information or click on a link. Successful phishing attempts could steal credentials, passcodes, and place malware on your computer. 91% of cyberattacks started as a phishing email.

- Fake invoices and payment redirects: Cybercriminals may pose as suppliers and send legitimate-looking invoices or notifications of changed bank details

Email remains the primary contact method used by fraudsters, followed by phone calls and text messages. These emails and malicious website links contained within them are difficult to distinguish from legitimate ones.

How these scams can impact your banking and payments

- Unauthorized transactions: Once scammers gain access or trick employees into wiring funds, your business could lose tens or hundreds of thousands of dollars in an instant.

- Delayed operations: The urgent need to investigate fraud in an effort to recover funds can halt or delay vendor payments and payroll.

- Loss of trust: If your clients’ data or payments are compromised, it can damage your company’s reputation and relationships.

- Regulatory risk: Mishandling customer or payment data may result in compliance issues or fines, especially under privacy laws.

Internal steps to take

Efforts to reduce fraud and its impact begin with your business, where it’s critical to instill important lessons and implement a series of controls. Here are some internal levers to pull that can power your efforts.

- Educate your team: Train employees to recognize suspicious emails, phone calls, or urgent payment requests.

- Protect your access: Use unique complex passwords and change them regularly. Establish separate access per user – do not share.

- Use dual authorization for payments: Set up procedures where two people must approve large or unusual transfers.

- Verify changes in payment details: Always confirm changes to vendor payment information verbally through an established known contact – NOT the contact information within payment change emails.

- Enable strong authentication: Use multi-factor authentication on all your banking, payroll, and email systems.

- Stay in touch with your bank: Leverage fraud monitoring, transaction alerts, and bank-provided security tools.

- Have a response plan: Know what to do if something goes wrong. Notify your bank immediately and report incidents. Change all passwords, review past payments, and stop unprocessed or questionable payments.

How to protect your business

Fraud prevention is a partnership between you and your bank. It’s smart to take advantage of the right banking tools - such as products that are specifically designed to help detect, better prevent, and increase the response to fraud attempts.

- Account Validation Services: Verify the ownership of a recipient’s bank account before sending a payment. These are especially useful in cases of onboarding new vendors or verifying payment changes.

- Positive Pay & Payee Positive Pay: Helps detect check fraud by matching checks issued by your business with those presented for payment to confirm the serial number, dollar amount, and in the latter case, the payee’s name.

- Check Block: Restricts accounts not used for check writing so that any checks presented for payment are returned.

- ACH Positive Pay: Monitors incoming ACH transactions in real time with customizable rule sets.

- ACH Debit Block: Restricts accounts not used for ACH Debits to prevent all ACH Debit attempts.

- Dual control & transaction approval workflows: Adds internal checks by requiring multiple approvals for key transactions.

- Dual authentication: Provides stronger security for online banking access.

- Real-time alerts & notifications: Immediately flags certain suspicious transactions or logins

It’s your move

Social engineering scams can hit fast and hard - with high-dollar consequences. Your organization doesn’t have to be vulnerable. With the right controls, awareness, and banking partnership, your organization can significantly reduce the risk and build a more secure environment for your payments, payroll, and vendor relationships.