Do you know who you’re talking to?

Imposter scams generally take place when criminals impersonate a trusted figure, company, or website to steal your personal information, take over your account, or influence you to send payments for fraudulent purposes. These scams may be carried out through an email (phishing), phone call from a falsified number (vishing), text message (smishing), or social media message.

Scams are on the rise with a record $12.5 billion reported stolen through fraudulent schemes last year, up 25% from $10 billion in 2023. Imposter criminals may pretend to be government officials, bank or business representatives, technical support professionals, police officers, romantic interests, relatives in trouble, or even celebrities. Their goal is to gain access to your personal data or scam you out of your money.

There are several ways that imposters try to trick you into giving your sensitive information.

Two common scams include:

Business imposter scams:

Business imposter scams are a growing problem where criminals are becoming increasingly convincing by replicating how businesses communicate with their customers. Some examples of this include:

- Fake purchases, transactions, or deliveries: Fraudulent messages may contain links that are designed to capture sensitive information. The message may state that they need information to resolve an issue with your order or delivery, etc. By clicking on the link, criminals can download malware to your device or trick you into providing personal information.

- Membership renewals: Scammers take advantage of people not remembering when their memberships are due and trick them into sending renewal payments.

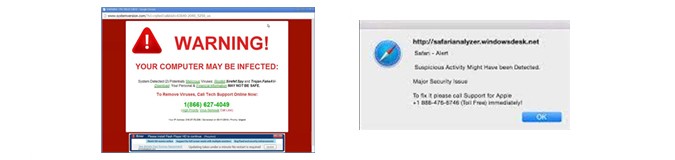

- Tech support scam: This common scam tricks users into believing they’re getting assistance in fixing a technical issue when criminals are really gaining access to their device to perpetrate fraudulent activity. Never allow access to your device due to unsolicited calls, pop-ups, emails or texts stating your device needs to be cleaned or fixed. This gives a scammer the ability to control your computer and virtually everything on it, which will remain until it’s removed by a professional, enabling ongoing fraud attempts.

They could look like:

Government imposter scams:

Government imposter scams grew significantly—from $171 million in 2023 to $789 million in 2024. Fraudsters disguise themselves as trusted sources, such as the IRS, Social Security, or other government agencies claiming you may owe more taxes, they can help increase your benefits, or there’s a possible warrant out for your arrest. They may even “spoof” or disguise their phone number, so it appears that calls are coming from a government agency. It’s important to know that government agencies almost always communicate by letter delivered via USPS. The IRS will only ever communicate via USPS.

- Slow down! Fraudsters often stress urgency to lure someone into providing confidential information or sending a payment. Do not make a payment or transfer money as a result of an unexpected email, phone call, or text.

- Always verify the source of an unexpected email, call, or text using your own known contact information. Fraudsters can spoof phone numbers, so it may appear to be a legitimate company’s number calling you. Do not click links or call phone numbers they provide. Use contact information that you locate yourself.

- Be mindful of websites – that are of poor quality. Misspelled words, grammatical errors, and strange or unfamiliar website domains are signs it’s not legitimate. When possible, type in the URL directly versus using a search engine. When using a search engine be wary of websites that are listed as “ads.”

- Be aware. If something sounds too good to be true, it probably is.

Be mindful when people you don’t know are asking for your information. As a general rule, M&T will not:

- Ask for your password or one-time passcode (OTP) for verification purposes

- Ask you to install software on your device

- Remotely access your device to take action on your account

- Access or move funds held in your account(s)

- Request you send a payment in order to initiate a fraud claim

If you’ve been scammed, attempt to reverse the transaction as soon as possible, report it to your bank, the Federal Trade Commission (ReportFraud.ftc.gov ), and IdentityTheft.gov (if you’ve given out your Social Security number), and file a police report. If you’ve given your username and password, immediately log in and create a new password for every account or app it applies to.